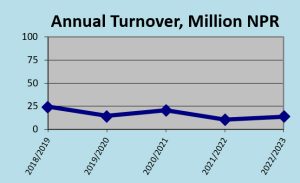

Annual turnover in the last Five years is as follows.

|

|||||||||||||||||||||||||||||||||||

MULTI has a firm and stable financial basis, which allows for a smooth and effective undertaking of the projects. The company’s access to credit facilities exceed over NRs. 20 million. The Company’s accounting system is highly developed and advanced computer software is used. The annual turnover of the company for the last five (5) years based on the audited reports in the following table.

| S.No. | Years | Amount Currency, NPR | ||

| Nepali | Gregorian | |||

| 1. | 2079/080 | 2022-2023 | : | 13,618,571.00 |

| 2. | 2078/079 | 2021-2022 | : | 10,564,204.00 |

| 3. | 2077/078 | 2020-2021 | : | 20,390,528.00 |

| 4. | 2076/077 | 2019-2020 | : | 14,381,885.00 |

| 5. | 2075/076 | 2018-2019 | : | 24,375,277.00 |